Corporate Governance

Corporate Governance

Basic Approach

We recognize that management transparency and the monitoring of progress toward management targets are extremely important. This is reflected in our wide-ranging initiatives to strengthen corporate governance.

For details, please see our Corporate Governance Report.

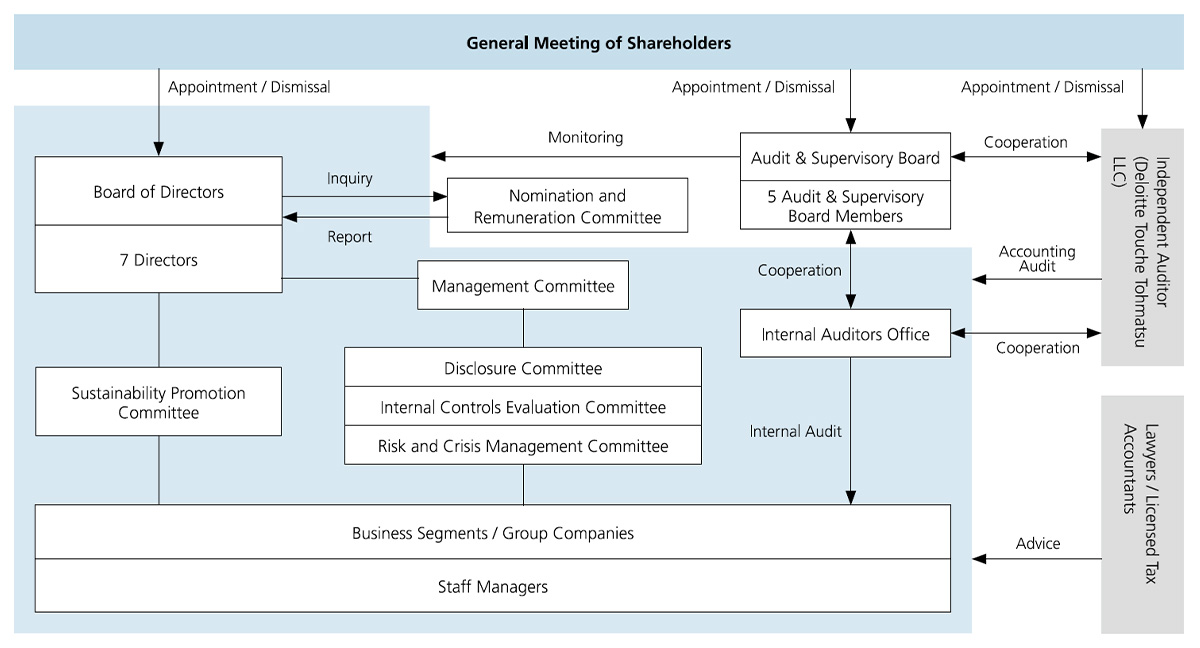

Corporate Governance Structure (As of March 29, 2024)

Main Meeting Body

| Board of Directors | We maintain a structure in which the representative director oversees Companywide business strategies and execution, while supervision of business domains and headquarters functions is primarily through executive directors, and add at least two independent outside directors to ensure sound management. In accordance with laws and ordinances, the Board of Directors monitors important decisions and implementation. Other decisions are handled by the representative director or under the representative director's direction and supervision through executive officers whom the Board of Directors appoints through its resolutions to assume responsibility for making and implementing decisions for business domains and headquarters functions. |

|---|---|

| Audit & Supervisory Board | The Audit & Supervisory Board functions independently of the Board of Directors, and comprises individuals who are familiar with the Company's business or corporate management and who have accounting or other expertise. At least one outside Audit & Supervisory Board member is an outside person who fulfills the independence criteria of Standard that the Board of Directors separately determines. The Audit & Supervisory Board cooperates with the independent auditor and the Internal Auditors Office to assess performance and corporate assets and ensure sound management. |

| Nomination and Remuneration Commitee | The Company maintains a voluntary four-person Nomination and Remuneration Committee comprising the president & representative director, one director, and two independent outside directors. This Committee deliberates on the nomination of candidates for director, Audit & Supervisory Board member, and vice president positions, as well as considering the appropriateness of the remuneration system for directors and executive officers who are vice presidents or above, and reports to the Board of Directors. |

Outside Directors and Outside Audit & Supervisory Board Members

Canon MJ has three outside directors and three outside Audit & Supervisory Board members. Pursuant to the consent of all Audit & Supervisory Board members and the approval of the Board of Directors, we implemented our Independence Standards for Independent Directors/Audit and Supervisory Board Members in order to clarify the standards for ensuring the independence of outside directors and outside Audit & Supervisory Board members in keeping with Japan's Corporate Governance Code and the independence criteria set by securities exchanges in Japan. Our outside directors and outside Audit & Supervisory Board members satisfy the independence criteria and help maintain and improve the transparency and accountability of the Board of Directors. The Company does not have dedicated organizations or employees to assist outside directors or outside Audit & Supervisory Board members in their duties. Executive directors and other officials provide outside directors with prior explanations of Board of Directors' meeting agendas as needed. Internal auditors, directors in charge of operations, and other officials provide outside Audit & Supervisory Board members with prior explanations of Board of Directors' meeting agendas as needed. Outside Audit & Supervisory Board members attend Audit & Supervisory Board meetings, as well as liaison meetings conducted as needed, to exchange information on important matters and audit details among Audit & Supervisory Board members.

Skills Matrix of Directors

| Skills Matrix | ||||||||

|---|---|---|---|---|---|---|---|---|

| Corporate Management | Sales & Marketing | Finance & Accounting | Human Resources | Legal Affairs & Risk Management | IT Solutions & DX | |||

Masachika Adachi

|

President & Representative Director |

● |

● |

● |

● |

|||

Minoru Mizoguchi

|

Director & Senior Vice President |

● |

● |

● |

||||

Hatsumi Hirukawa

|

Director & Senior Vice President |

● |

● |

● |

||||

Tsuyoshi Osato

|

Director & Vice President |

● |

● |

● |

||||

| Outside/Independent | Yoshio Osawa

|

Director |

● |

● |

● |

|||

Toshiharu Hasebe

|

Director |

● |

● |

● |

||||

Hiroko Kawamoto

|

Director |

● |

● |

● |

||||

Reasons for selecting the items of the skills matrix

|

Item

|

Reason for selection Corporat

|

|---|---|

| Corporate Management | Improving corporate value through continued growth and contributing to building a sustainable society requires members of the Board of Directors who have skills and knowledge for promoting sustainability and experience and knowledge concerning corporate management and the formulation and implementation of medium- and long-term management plans and frameworks. |

| Sales & Marketing | In a rapidly changing society, quickly responding to the needs of customers and providing high value-added products and solutions will lead to solutions to issues faced by society and customers, and the creation of value. Achieving this requires members of the Board of Directors who have experience and knowledge concerning the formulation of sales strategies and the understanding of market trends. |

| Finance & Accounting | Achieving the improvement of corporate value through efficient use of funds requires members of the Board of Directors who have the experience and knowledge needed to ensure accurate financial reporting, build a strong financial foundation, and strike a balance between investment for further growth and return to shareholders. |

| Human Resources | To achieve the improvement of corporate value, it is important to maximize human capital by boosting the skills and engagement of employees. This requires members of the Board of Directors who have experience and knowledge concerning human resources development and skills for managing diverse human resources. |

| Legal Affairs & Risk Management | Achieving the improvement of corporate value through stable business operations requires members of the Board of Directors who have profound knowledge of related laws and regulations, the experience and knowledge needed to build a proper governance system, and skills for risk management. |

| IT Solutions & DX | Creating a “professional corporate group that solves social and customer issues using ICT and the power of humans” requires members of Board of Directors who have experience and knowledge in the fields of IT solutions and digital technology. |

Internal Audits

The Internal Auditors Office (IAO) was established as an independent organization dedicated to performing audits of the Company and operating under the direct supervision of the President of the Company. IAO prepares the policies of the internal audit divisions of the Company and the entire Group and conducts audits of all management activities to examine the reliability of financial reports, the effectiveness and efficiency of business operations, compliance with laws and regulations, and the protection of corporate assets, and assesses the results of audits and provides advice to the audit targets.

The results of audits are reported regularly to the President & Representative Director, other Directors and the Audit & Supervisory Board.

In addition, the internal audit divisions of Canon IT Solutions Inc. and Canon System & Support Inc. conduct audits under the same policies. The Canon MJ Group has about 60 audit staff members.

Selection of Independent Auditors

The Company selects independent auditors, having comprehensively considered quality management system of the accounting firm, the independence of audit team, the level of audit fees and communications of the independent auditors with Audit & Supervisory Board Members, the management and the internal audit divisions.

The regular rotation policy of Engagement Partners is as follows.

- Engagement Partners are not to be engaged in the accountancy service more than 7 consecutive accounting periods.

- Lead Engagement Partners are not to be engaged in the accountancy service more than 5 consecutive accounting periods.

In case the independent auditor(s) is/are deemed relevant to each item of the Paragraph 1, Article 340 of the Companies Act, the Audit & Supervisory Board will dismiss the independent auditor(s) with the consent of all the Audit & Supervisory Board Members, as necessary.

Moreover, the Audit & Supervisory Board prepare the proposals for the General Shareholders’ meeting to dismiss the independent auditor(s) or refuse the reappointment, in case the accountancy service is not regarded to be provided appropriately due to occurrence of grounds for harming qualification and the independence of the independent auditor(s).

Analysis and Evaluation of Effectiveness of the Board of Directors

We conducted a questionnaire for directors and Audit & Supervisory Board members on the effectiveness of the Board of Directors and analyzed and evaluated the effectiveness of the Board of Directors. The assessment criteria were (1) deliberations of the Board of Directors, (2) the composition of the Board of Directors, (3) succession planning, and (4) the sufficiency or process of discussions. These talks confirmed the overall effectiveness of the Board of Directors. Going forward, we will strive to ensure and improve the effectiveness of the Board of Directors even further by continuing to enhance discussions on matters to be considered by the Board of Directors as well as its composition, management training, and other matters. In this way, we will improve the decision-making function of the Board of Directors by incorporating the opinions of directors and Audit & Supervisory Board members obtained through the questionnaire into the operation of the Board of Directors, thereby achieving sustainable growth and increasing corporate value over the medium to long term.

Based on the results of the evaluation in fiscal 2022, the Company has considered the composition of the Board of Directors, and from the perspective of improving service quality and ensuring diversity, at the 55th Ordinary General Meeting of Shareholders held on March 29, 2023, the Company appointed one female outside director with extensive experience in and exceptional insight into corporate management, the service industry, and diversity.

Training Policy for Directors and Audit & Supervisory Board Members

The Company conducts training for directors and Audit & Supervisory Board members on appointment for the purpose of ensuring that they understand their roles and job responsibilities and that they have the knowledge necessary or useful to appropriately fulfill their duties. In addition, the Company has established a system in which they can attend internal and external training sessions at the Companyʼs expense after taking office. Furthermore, we provide outside directors and outside members of the Audit & Supervisory Board with opportunities to attend business report meetings and other meetings to help them attain a deeper understanding of our business.

Initiatives to Enhance Corporate Governance

Remuneration for Senior Executives and Directors

-

Policies and Procedures for Determining Remuneration

The Nomination and Remuneration Committee verifies the appropriateness of the remuneration system for directors and executive officers who are vice presidents or above, including the standards for calculating basic remuneration and bonuses and the criteria for granting stock compensation-type stock options. The amount of individual remuneration is determined in line with the remuneration structure, of which basic calculation approaches were resolved at meetings of the Board of Directors and have been verified by the Nomination and Remuneration Committee. The total of basic remuneration and stock compensation-type stock options for directors must be less than the maximum total remuneration approved at general meetings of shareholders. Bonuses, however, are determined when proposals for them are approved at ordinary general meetings of shareholders.

-

Composition of Remuneration

Remuneration for the representative director and directors consists of basic remuneration, which is a fixed basic monthly fee for executing their roles and duties; a bonus linked to performance in the fiscal year; and stock compensation-type stock options as incentives to promote improvements in medium- to long-term business performance and corporate value. The same applies to remuneration for executive officers who are vice presidents or above. Outside directors only receive basic remuneration. With regard to the proportion of basic remuneration, bonuses, and stock compensation-type stock options, because we believe that it is important to engage with management from a medium- to long-term perspective, our basic approach is to emphasize the level and stability of basic remuneration. At the same time, with the aim of enhancing performance over the course of a single fiscal year, bonuses and stock compensation-type stock options for directors can account for up to approximately 30% and approximately 20% of basic remuneration, respectively.

Policies and Procedures in the Appointment / Dismissal of Senior Executives and the Nomination of Candidates for Director and Audit & Supervisory Board Member

-

Policy

In principle, director and Audit & Supervisory Board member candidates, vice presidents, and higher-ranking executive officers are elected from among those who are deemed capable of fulfilling the duties fairly and appropriately, have a high level of insight, and fulfill the following requirements, regardless of their gender, nationality, ages, and other individual attributes.

<Representative director and director>

Having a true understanding of the corporate philosophy and code of conduct of the Company, as well as a broad familiarity with the Company's businesses and operations, both of which are gained through the experience of serving as an executive officer, for example, and the ability to make effective decisions from a higher perspective, looking at multiple businesses and headquarters functions

<Independent outside director>

Having a high level of expertise and extensive experience in fields such as business management, risk management, law, and economics, in addition to meeting the independence criteria that are separately determined by the Board of Directors

<Audit & Supervisory Board member>

Having a high level of expertise and extensive experience in fields such as business management, finance, accounting, and internal control. At least two outside Audit & Supervisory Board member shall fulfill the independence criteria that are separately determined by the Board of Directors.

<Vice president or higher-ranked executive officer>

Having been highly evaluated in terms of performance, ability, and personality in managerial assessment, having sufficient knowledge, experience, and judgment to bear the responsibility for execution in specific fields, and truly understanding the corporate philosophy and code of conduct of the Company.

-

Appointment and Nomination Procedures

The Company maintains a voluntary five-person Nomination and Remuneration Committee comprising the president, one director, and three independent outside directors.

To nominate director or Audit & Supervisory Board member candidates and appoint vice presidents (including successors and candidates for president and representative director), the president and representative director first nominates candidates from among those fulfilling requirements. The nomination is submitted at a meeting of the Board of Directors after the Nomination and Remuneration Committee confirms that it is fair and appropriate.

The Audit & Supervisory Board discusses and consents to nominees before deliberations by the Board of Directors.

-

Dismissal Procedures for Management Team Executives

Directors and Audit & Supervisory Board members can ask the Nomination and Remuneration Committee for deliberations at any time to decide whether the dismissal of a representative director, executive director, or executive officer who is a vice president or above (collectively, "management team executives") is necessary in the event of illegal, unfair, or treasonous behavior among such individuals, if they have failed to fulfill their roles, or for other reasons that make such people unsuited to retain their posts as management team executives.

All results of Nomination and Remuneration Committee deliberations shall be submitted to the Board of Directors, regardless of the outcome of Board of Directors' deliberations on the necessity of dismissal. The management team executives subject to deliberations cannot join in discussions.

Protection of Minority Shareholders in Transactions with the Controlling Shareholder

The controlling shareholder of the Company is the parent company, Canon Inc. Important master agreements for transactions with the controlling shareholder are concluded following a resolution by the Board of Directors. In addition, for a risk of conflicts of interests occurring between controlling shareholder and minority shareholders regarding which deliberations and considerations are deemed necessary for the purpose of protecting the interests of minority shareholders, the Special Committee consisting of Independent Outside Directors makes discussions and delivers a report to the Board of Directors. No arbitrary decisions are made on terms, etc. of transactions with the controlling shareholder. In addition, the Company protects the interests of all its shareholders by conducting all transactions appropriately and fairly, including transactions with the controlling shareholder, to ensure there is no damage to the Company’s independence and interests.

The status of recent activities of the Special Committee is as described below.

May 22, 2024 Deliberation regarding subject of consideration by the Special Committee

July 11, 2024 Deliberation regarding tender offer for acquisition of own stock

July 16, 2024 Deliberation regarding tender offer for acquisition of own stock

July 24, 2024 Deliberation regarding tender offer for acquisition of own stock

August 8, 2024 Confirmation of purchase from parent company

Independence from the Parent Company

-

The parent company’s policy on Group management

Canon Inc., the parent company of the Company, believes that the Canon Group can achieve sustainable growth and increase its corporate value in the medium to long term if the Canon Group’s companies, including the Company, fulfill their social responsibilities through their corporate activities based on Canon’s corporate philosophy, Kyosei, and continue to strive to realize Kyosei.

Canon Inc. shares its management strategies with its listed subsidiaries, including the Company, to ensure that the Canon Group will efficiently achieve the targets of its medium- to long-term management plan, Excellent Global Corporation Plan Phase VI (2021-2025), through comprehensive optimization. The policy of Canon Inc. states that its listed subsidiaries, including the Company, will seek to post consistent earnings and maximize consolidated earnings to increase the corporate value of the entire Canon Group.

On the risk management front, all of the Canon Group companies, including the Company, are working to share policies and information and develop systems to work as one team on sustainability matters, such as compliance, internal control, risk management, economic security, decarbonization, global warming mitigation and respect for human rights.

One of the Canon Group’s important management policies is to protect the interests of the minority shareholders of Canon Inc. and its listed subsidiaries. This policy involves allowing the listed subsidiaries to maintain a high degree of independence and flexible management systems. Due to this policy, Canon Inc. does not participate in the Company’s decision-making process regarding individual issues.

-

Reasons why it is significant for the parent company to have a listed subsidiary

In addition to the sale of Canon's products and services, the Company sells other companies' products and provides services and IT solutions in response to the needs of customers and its own businesses. As described above, the Company operates independently. As a listed company that is independent of the parent company, the Company has a process that enables it to make decisions promptly and flexible financing methods. This allows the Company to broaden its non-Canon businesses. In addition, the Company can leverage its creditworthiness as a listed company to increase the number of customers and business partners, hire excellent human resources and keep its employees highly motivated. For these reasons, Canon Inc. has decided that the Company as a listed company will contribute to maximizing the value of the Canon Group.

-

The parent company's involvement in the Company's management

The management of the Company is independent of the parent company. No officers of the parent company concurrently serve as officers of the Company. To enhance its governance, the Company has established a Nomination and Remuneration Committee, and a majority of the committee's members are Independent Outside Directors. The committee’s decisions are duly considered in the Company's appointment and dismissal of Directors, etc. and in determining their remuneration.

The Company applies the arm’s length rule to the transactions between the Company and the parent company to ensure that the transactions are proper. We are committed to avoiding unduly harming the interests of the minority shareholders of both the Company and the parent company.

The Company has established a Special Committee which deliberates and considers the risk of a conflict of interest occurring between the controlling shareholder and minority shareholders to mitigate these risks. The Special Committee is explained in the aforementioned Protection of Minority Shareholders in Transactions with the Controlling Shareholder.

Basic Approach to and Preparations for the Exclusion of Antisocial Forces

-

Basic Policy

The Company and Group companies maintain a resolute approach to antisocial forces that threaten the order and safety of civic society, and the basic policy is to eliminate all relationships with antisocial forces.

-

Status of Preparations

-

In addition to setting out action guidelines to eliminate relationships with antisocial forces, the workplace regulations of the Company contain provisions to the same effect, and we work to ensure that employees fully comply with these guidelines and provisions.

-

The general affairs division of the head office of the Company has been designated as the Group's control division in charge of responding to antisocial forces. It shares information on antisocial forces with the general administration departments of the respective branches and works to prevent transactions, etc., with antisocial forces before they occur.

- A collaborative structure has been built with the police, attorneys-at-law, and other external organizations.

- Payments of contributions, etc., are examined in advance in order to confirm that there are no problems of legality or corporate ethics.

-

In addition to setting out action guidelines to eliminate relationships with antisocial forces, the workplace regulations of the Company contain provisions to the same effect, and we work to ensure that employees fully comply with these guidelines and provisions.

Internal Control

Based on the Companies Act, the Company has determined the basic policy for its internal control system to ensure appropriate business practices and is deploying that system in line with the policy. The Internal Controls Evaluation Committee has been established for the purpose of developing an internal control system for the entire Canon MJ Group, consisting of officials representing corporate departments and subsidiaries.

- Response to the Financial Instruments and Exchange Act in Japan

In accordance with the Financial Instruments and Exchange Act, listed companies must now submit reports on internal controls. The Company started to submit internal control reports on the evaluation of the effectiveness of internal controls on financial reporting in the fiscal year ended December 31, 2009.

Strategic Shareholdings

-

Policy for Strategic Shareholdings

The Canon Marketing Japan Group only holds shares of other listed companies when these shareholdings help to improve the corporate value and the mid- and long-term development of the Group, taking into consideration things such as our management strategies, business alliances, the maintenance and strengthening of transactions, the development of collaborative businesses, and the creation of new forms of synergy.

-

Review of the Reasonableness of Strategic Shareholdings

The Company reviews the reasonableness of individual reciprocal cross-shareholdings at meetings of its Board of Directors in a comprehensive assessment that considers the significance of shareholdings and other results of a qualitative evaluation as well as a quantitative evaluation of the transaction value with investment targets, dividends, and whether unrealized gains are commensurate with capital costs, on a regular basis each year. As a result of the review, when it is judged that holding certain shares is no longer reasonable, the holding will be reduced through the sale of said shares. The number of the shares we hold decreased from 49 (as of end December 2023) to 45 (as of end December 2022).

-

Policy for Exercising the Voting Rights of Strategic Shareholdings

While respecting the management philosophy, business strategies, etc. of each investment target, the Company establishes specific standards based on judgment criterion of whether they contribute to the interests of shareholders in general, and according to that standard, the Company exercises its voting rights of cross-held shares.

If a shareholder of the Company is holding shares of the Company in a cross shareholding and offers to sell its shares of the Company, the Company shall take no action seeking to interfere with the intended sale of the shares, such as indicating the possibility of reducing transactions with the shareholder.

Policy for Constructive Dialogue with Shareholders

To contribute to the sustainable growth and medium- to long-term enhancement of corporate value, the Company holds constructive dialogue with shareholders through various means, such as general meetings of shareholders, briefings on long-term management objectives and medium-term management plans, financial results briefings, and interviews with major institutional investors.

Business Management Organization and Other Corporate Governance Systems regarding Decision Making, Execution of Business, and Oversight

| Maximum number of directors stipulated in Articles of Incorporation | 21 |

|---|---|

| Term of office stipulated in Articles of Incorporation | 1 year |

| Chairperson of the Board of Directors | President |

| Number of directors | 7 |

| Appointment of outside directors | Appointed |

| Number of outside directors | 3 |

| Number of outside directors qualifying as independent directors | 3 |

| Committee's name | Total number of members (persons) | Full-time members (persons) | Internal directors (persons) | Outside directors (persons) | Outside experts (persons) | Other (persons) | Chairperson | |

|---|---|---|---|---|---|---|---|---|

| Committee corresponding to Nomination Committee | Nomination and Remuneration Committee | 5 | 0 | 2 | 3 | 0 | 0 | Internal director |

| Committee corresponding to Remuneration Committee | Nomination and Remuneration Committee | 5 | 0 | 2 | 3 | 0 | 0 | Internal director |

| Establishment of Audit & Supervisory Board | Established |

|---|---|

| Maximum number of Audit & Supervisory Board members stipulated in Articles of Incorporation | 5 |

| Number of Audit & Supervisory Board members | 5 |

| Number of independent directors and Audit & Supervisory Board members | 5 |

|---|

Please refer to ESG Data for more details on Governance data.

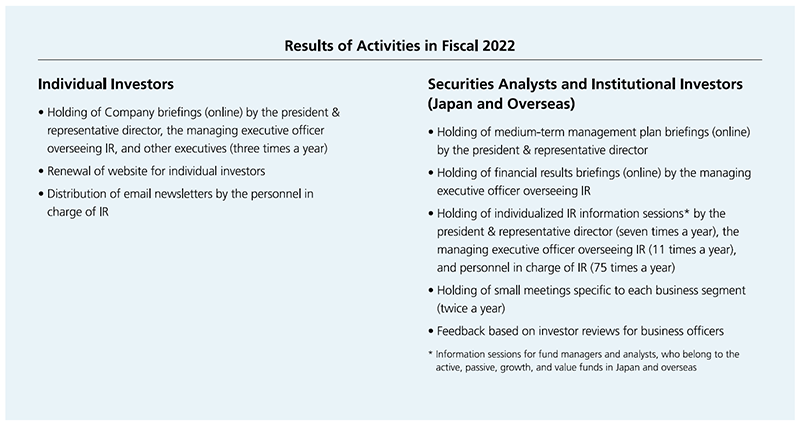

Status of IR Activities

The Company aims to build long-term relationships of trust with everyone participating in capital markets and acquire suitable appraisals by making timely, appropriate, and fair disclosure of not only financial information but also non-financial information and by enhancing opportunities for dialogue. In addition, we strive to report insights and assessments brought to light through dialogue to the Board of Directors, the Management Committee, and other decision-making entities and reflect them in the Company's management in order to achieve improvements in corporate value over the medium to long term. We have established the Canon MJ IR Policy to clarify our stance to investor relations (IR) disclosure, which is disclosed on the IR website.